Single Touch payroll support in c9 is substantially automated and normally processing payruns STP only adds a couple of extra clicks to capture authority to send. Though there are a couple of things to setup and manage:

- Initial setup

- Submit on pay run

- Dealing with errors and issues

Initial Setup

Making sure all staff are setup correctly

For existing staff you need to make sure following information is in play

- Their Tax File Number

- Correct full name and address. (Name can be either in 'name' field' or broken apart into firstname/lastname fields. If firstname/lastname are empty c9 will break name into firstname/lastname for you)

- Date of Birth.

- Suggest : put in staff email address and phone numbers as these will be sent to ATO,

For new staff, from now on their first payrun will transmit alot more information. Critical things you must put in for their first pay run:

- Same info as above. Plus:

- An actual start date

- TFN declaration signed and date of signature. (Might be different to when they actually started)

- Residency status & full time/part time/casual designation

- If they have HECS/HELP or student loan this is setup On advanced tab

For staff leaving, make sure you key in a termination date. This is necessary anyway for computing severance pay, but this information is important for STP too

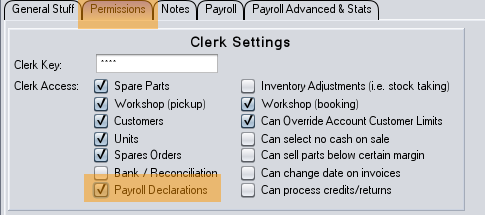

Permission to send STP data

Single Touch Payroll requires a declaration of who is sending the information to the ATO. This creates a new clerk key permission to track this. So payroll management works on two permission levels.

- Login level to define which logins to c9 can access payroll data overall

- Clerk key level for providing authority to submit payroll data

In staff, you can modify permissions on staff to grant permission to submit. i.e. on permission tab

Note, this only needs to be done for the person(s) whose job it is to manage payroll. Do not set this for all staff.

Submit on payrun

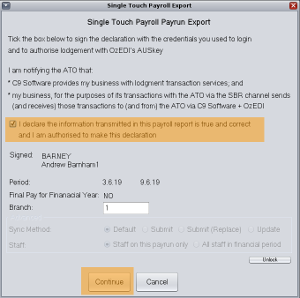

On completion of a payrun. C9 will pop a screen to request transmission of payrun data to ATO. Click on declaration checkbox, click on Continue. Then click on nag to confirm this and you are done.

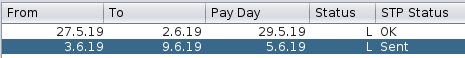

In payrun list it will show STP status for that pay run as SENT

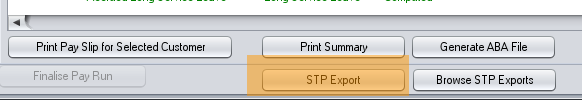

You can manually send STP data if for some reason you don't do it on payrun finalization. To do this, from view / modify payrun click on STP export to manually send/resend

Eventually ATO systems will reply to c9 and c9 will update the payrun's STP status to either OK or Error. This happens automatically in the background and can take from a few minutes to a few days to complete.

Dealing with Errors or issues

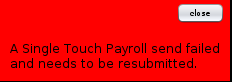

If ATO reply with an error, c9 alerts will nag this. i.e.:

To view errors goto payruns and find payrun whose error status is Error. View it and click on Browse STP Export to see history.

In below screnshot, it is telling us that email address for staff member with code of S05MR is invalid. Repair will involve double checking their details and fixing their email address before resubmitting.